Europe Is Divorcing Israeli Tech

Israeli VCs are finding it much harder to raise money from European limited partners they were used to doing business with

Welcome to Israel Tech Insider. I’m Amir Mizroch, a tech communications advisor and former EMEA Tech Editor at The Wall Street Journal. This newsletter is about connecting the dots to give you a sharp, insider’s take on what’s really going on in Israel’s tech industry.

As always, feedback to amir@israeltechinsider.com

European Funds Are Ditching Israeli Tech

Israeli tourists are getting kicked out of restaurants in Italy, Spain, Austria, and Greece. Israeli football fans are being hunted in the streets of Amsterdam. Israeli musicians are getting their concerts canceled throughout Europe. Now it’s the turn of Israeli venture capitalists.

Over the past several weeks, as the humanitarian situation in Gaza has dominated global headlines, several Israeli VCs, as well as non-Israeli Jewish VCs at American firms who are active in Israel, say European funds are quietly halting investments in their funds. The European pullback includes sovereign wealth funds, public and private pension funds, fund of funds, family offices, and other financial institutions, Israel Tech Insider has learned. The pullback by LPs is being implemented across Europe and the Nordics.

VCs who informed this article requested anonymity to discuss sensitive financial and political matters. They say examples range from European LPs stalling on new capital allocations to outright rejections framed as avoiding ties to ‘an Apartheid state.’ According to one source, the chill even extends in some cases to non-Israeli Jews working at foreign VC firms active in Israel, including those who have recently hired Israelis to source deals on the ground in Israel.

“We are becoming Russia without the official sanctions,” one Israeli VC with longstanding connections in Europe, told me.

This coincides with reports—some verified and others falsified—of severe hunger in Gaza, as the IDF continues its assault on Hamas military and governing infrastructure. The IDF’s efforts include trying to cut off Hamas’ access to humanitarian aid, some of which it steals to supply its own ranks, while selling it back to impoverished Gazans at high prices. These efforts seem to have mostly failed, as Israel this past week started opening crossings for UN humanitarian convoys as well as air-dropping food aid into Gaza.

That may have come too late for some European investors.

Caveat #1: European LP funding of Israeli venture capital has always been limited. The vast majority (+70%) of foreign institutional funding of Israeli VC has been American. Still, even the limited European LP activity has started to retreat. European pension giants and sovereign funds, most notably from Norway and The Netherlands, are pulling back from Israel at record pace, with landmark divestments, a collapse in tech investment to six-year lows, and Europe’s share of foreign deals plummeting. All of this is driven by Gaza-war geopolitics, rising European anti-Israel sentiment, stricter regulations, and economic malaise throughout the Old Continent.

Caveat #2: This article is not a data-led survey of European capital flows to Israeli and non-Israeli Jewish VC partners. It is “anecdata” and I don’t want to pretend it’s anything else. Still, the sources I spoke to on this are experienced Israeli operators with solid European networks, and they’re sufficiently concerned by examples of this to call it out as a growing trend.

Caveat #3: None of this might come as a surprise: European and Nordic states have traditionally taken an oppositional stance toward Israel on the Palestinian conflict. Spain, Portugal, France, Slovenia, The Netherlands, and now even Germany and the UK have threatened/promised to recognize a Palestinian state. The European Commission this week proposed restricting financial support for Israeli technology companies through the Horizon Europe R&D program, which has a budget of nearly 100 billion euros. The decision, if enacted, will affect the participation of Israeli entities in the EIC Accelerator, which targets start-ups that have potential dual-use applications, such as in cybersecurity, drones, and artificial intelligence. It does not (yet) affect the participation of Israeli universities and researchers in collaborative projects and research activities under Horizon Europe. Still, Israeli academic institutions are losing access to European research collaborations, with universities like Delft in the Netherlands refusing to approve joint applications with Israeli institutions due to perceived military connections. There is also increasing activist pressure on other Dutch universities to cut ties with Israeli companies they conduct joint research with, specifically in the strategic semiconductor design space.

Caveat #4: I don’t see this having any discernible immediate impact on the ability of Israeli startups—especially those in core strategic sectors like AI, cyber, defense, and semiconductors—to raise money (outside of those sectors things are much more complex, as I reported in last week’s Israeli Tech’s Two State Conundrum). Other workarounds exist.

But breaking up is hard to do. TheMarker (Hebrew/Paywall) reports that European partners are telling Israeli companies "we need your technology but we're ashamed to be seen with you"—forcing a shadow economy of Polish shell companies, secret partnerships, and media blackouts that exposes the cowardly pragmatism of entities desperate for Israeli innovation while terrified of activist backlash.

A few thoughts about the situation:

While US firms have no problem funding defense and dual-purpose startups, European funds seem to be balking at having anything on their books that could tie them to Israeli military, defense, or cyber activities. This comes even as Europe boosts defense spending and modernization, and any boycott of Israeli defense, semiconductor, AI, or cyber technology could hurt Europe’s own defense efforts. If Europe wants to shoot itself in the foot (or worse), it can go ahead. The downside of that for Israeli companies is that they will find it even harder to do business with major European defense firms, once again putting all our eggs in the Pentagon basket.

Meanwhile, major US VCs with operations in Israel continue activities at pace. The problem is that just as Israel is geopolitically over-reliant on the US, so is Israeli tech funding. Diversification of funding sources is usually a good idea, and having a significant and long-term European pullback from Israeli tech, if that is indeed what’s happening, is not optimal. If there is a longer-term shift, it could threaten Israeli startups' access to European markets and expertise while concentrating geopolitical risk in the US-Israel investment axis. Israeli startups and VCs are now hyper-dependent on US capital flows with limited alternative sources. US investors recognize Israeli companies have fewer options, potentially extracting worse terms. A downturn in U.S.-Israel relations or U.S. market confidence could trigger a funding collapse. This is what really keeps Israeli VCs awake at night.

The problem is compounded by the fact that Israeli institutional investors have historically played a limited role in venture capital investments, despite government encouragement. Foreign VCs provide critical scaling capital that Israeli funds cannot match.

The Big Picture: The war that began on October 7, 2023 represents a watershed moment for Israeli high-tech, shattering a 20-year assumption that geopolitical violence in the region doesn’t materially affect tech sector performance. For the first time since the Second Intifada, the link between Israel’s security situation and tech sector performance has become visible and consequential. For a country whose only globally competitive sector is tech, this is not a good place to be in long term.

In other news

$25 Billion Blue-on-Blue Blockbuster

Israeli-founded Palo Alto Networks has announced a landmark $25 billion acquisition of Israeli cybersecurity firm CyberArk Software, marking one of 2025's largest tech takeovers and signaling accelerating consolidation in the cybersecurity industry. The deal strategically expands Palo Alto's portfolio into identity security—particularly privileged network access management—amid surging AI-driven threats and increasingly sophisticated cyberattacks targeting organizations worldwide. While the acquisition positions Palo Alto to deliver more comprehensive security solutions to enterprise customers, investors responded cautiously, with shares dropping 8% due to concerns about integration challenges for what represents an unusually large acquisition for the company.

SoftBank Vision Fund 2’s new stake in Israeli quantum computing startup Classiq is notable as a calculated move by a leading global investor following its own technical diligence on an increasingly credible quantum software platform. That SoftBank’s engineers confirmed Classiq’s ability to design real, high-performing quantum circuits for contemporary hardware is significant, indicating not just faith in Classiq’s team but a concrete bet that enterprise-grade quantum tooling is coming into focus faster than many expected. The investment—joined by Italy’s CDP Venture Capital—reflects a broader pivot in global tech capital, as Japan and Europe directly back foundational technologies rather than cede ground to U.S. and Chinese incumbents. At stake: as quantum hardware gradually improves, the competitive lines are being drawn over who will control its essential software layers, which in turn could shape advances in cybersecurity, pharmaceuticals, and finance. Whoever builds the enabling architecture for real-world quantum computing stands to wield lasting influence over the next era of technological and economic infrastructure.

I have skin in this next item: Teramount, an Israeli startup specializing in high-speed data connections for next-generation computing, just raised $50 million from a roster of heavyweight global investors led by Koch Disruptive Technologies. The company’s technology—essentially a “bridge” that links fiber-optic cables directly to advanced computer chips—aims to solve some of the biggest data bottlenecks facing today’s AI and data center operators. What sets Teramount apart isn’t just its cutting-edge product, but also its inclusive leadership: CEO Hesham Taha, one of the few Arab Israelis to lead a major tech company, has built a diverse team pulling talent across social divisions. As demand for powerful, scalable computing infrastructure accelerates, Teramount’s success signals both a technical leap for the industry and a new blueprint for diversity in Israeli innovation. About 4 years ago I worked on Teramount’s first corporate narrative profile (link to my Google Drive).

AI surveillance startup Lumana’s $40 million Series A round, driven by ex-Intel computer vision executives and led by Wing Venture Capital, highlights an accelerating shift in video surveillance from passive recording to AI-driven real-time analysis. The startup's core proposition converts standard camera feeds into behavior-analysis systems using vision language models capable of processing over one billion images daily. Unlike conventional surveillance that simply records, Lumana's platform identifies specific patterns (safety violations, missing equipment, unauthorized access) across thousands of distributed cameras, centralizing both detection and response functions. The AI video analytics market is projected to triple to $69 billion by 2028.

Israeli flying car firm AIR has raised $23 million, bringing its total funding to $50 million as it races to be among the first to get US approval for electric flying vehicles. AIR sells a two-seater electric aircraft called the AIR ONE, with over 2,500 pre-orders since 2022. The company is also developing a cargo drone for deliveries and emergencies. AIR plans to deliver 15 cargo aircraft next year and is expanding production in Israel and Florida. Its customers already include the Israeli and US Air Forces and Singapore.

VAST Data, an Israeli-founded AI storage platform, is in advanced fundraising discussions with Alphabet's CapitalG and existing investor Nvidia that could value the company at up to $30 billion, a significant jump from its previous $9.1 billion valuation in 2023. The New York-based startup, which develops technology to enhance efficiency in AI data centers, has gained substantial traction amid the growing AI infrastructure boom.

Resources

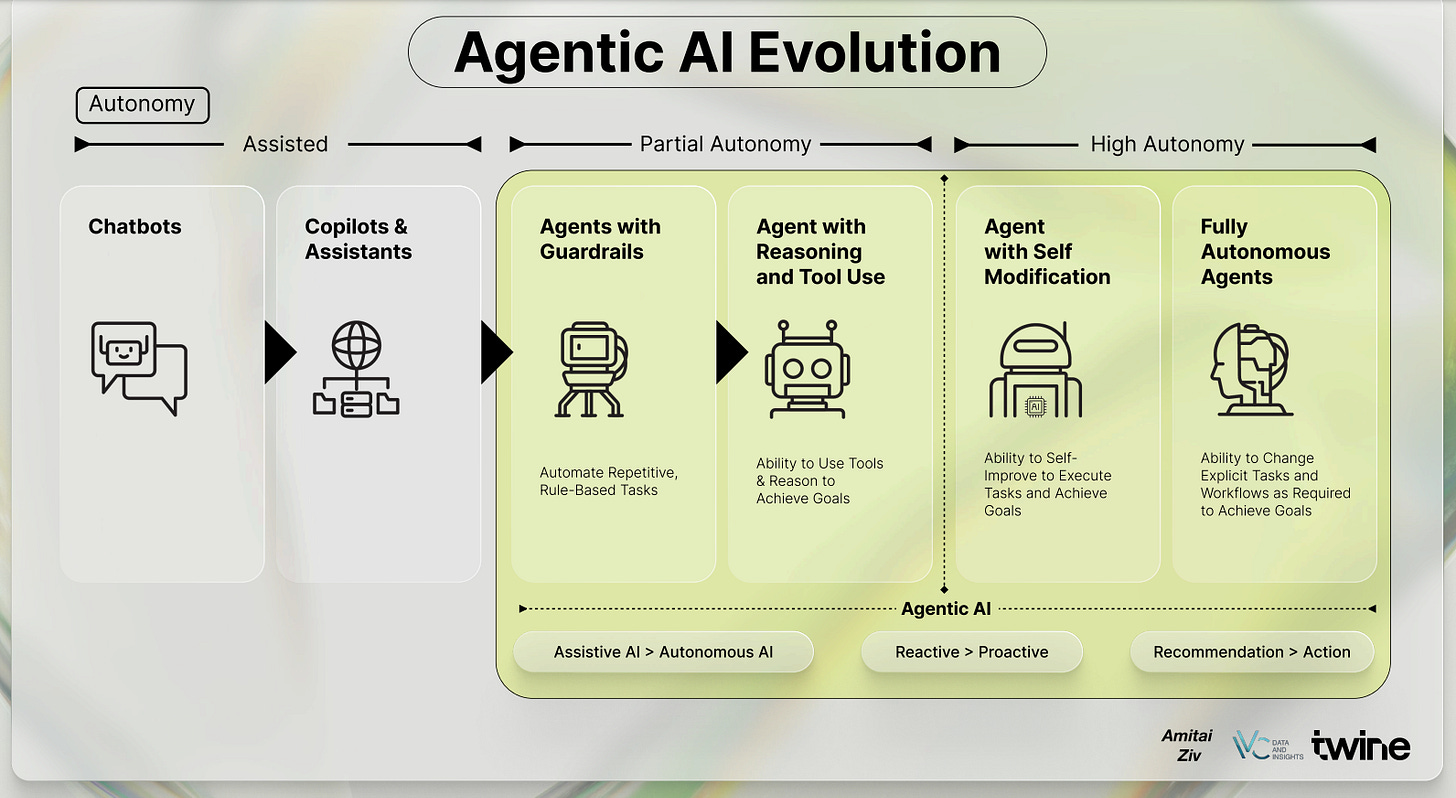

Twine’s Israeli Agentic AI Landscape map offers a rare x-ray of a sector quietly moving from flashy chatbots to autonomous AI agents capable of executing real-world tasks—often without human handholding. The map, compiled by Twine, a company that wants to be the next CyberArk, pinpoints the Israeli companies building everything from next-gen cybersecurity bots to orchestration platforms for complex, multi-agent workflows.

What matters most: As AI pivots from generating content to making decisions and taking action, Israel’s security-first, use-case-driven ecosystem may well shape global standards—deciding who trusts, regulates, and ultimately profits from tomorrow’s autonomous machines.

If Europe wants to shoot itself in the foot (or worse), it can go ahead 🤌 We will just build and sell more amazing tech and stuff 🇮🇱

Very Interesting, thank you. I shared on Fbook