Nearing Two Years of War, Israeli Tech Is Holding, and Hardening

War as a feature not a bug: Israeli tech has evolved beyond crisis management into crisis optimization.

Welcome to Israel Tech Insider. I’m Amir Mizroch, a communications advisor and former EMEA Tech Editor at The Wall Street Journal. This newsletter is about connecting the dots to give you a sharp, insider’s take on what’s really going on in Israel’s tech industry.

I’ve been on a much-needed vacation so please excuse the lapse in publishing. I’m back at my desk now, with some fresh reporting and perspective. As always, feedback to amir@israeltechinsider.com

Let’s dive in.

War as a Feature: How Israeli Tech Learned to Thrive in Permanent Crisis

Day 669. Nearly two full years into the war with Hamas, Israel’s tech sector, like the rest of the country, faces one of its most critical inflection points in recent memory. As tens of thousands of reserve soldiers get called up again—many from startups, many from elite units—the weight of sustained conflict is no longer abstract. It is operational, financial, personal. It’s the new normal.

Over the past 20 years, the tech industry has treated war as a recurring bug—small, contained conflicts lasting days, weeks, or, in the case of the 2006 Second Lebanon War, a month max. Tech was teflon to these bugs. Companies were founded, scaled, bought and sold during these short wars. Nothing seemed to knock tech off its stride.

The October 7 war’s length—it could be heading into its third year next month—is Israel’s longest by far. It has become a feature, not a bug. And it is transforming the tech industry, as much as the industry is transforming war. This creates competitive advantages (chaos management, accelerated decision-making, dual-purpose dissemination) but also structural vulnerabilities (conflict dependency, talent fragmentation, risk-conscious capital flight).

Within this, my sense is that Israeli tech has evolved beyond crisis management into crisis optimization. What began as adaptation to temporary conflict became systematic transformation for permanent instability. Israel isn’t built for long wars. Israeli tech is building itself for just that.

The industry is adapting, hardening, and in some sectors, flourishing. In many places, it is also quietly fraying. Through private conversations with startup founders, investors, and ecosystem operators, seven core themes have emerged that point to a vibe shift: Israel's tech sector didn't just adapt to crisis, it is at once devolving back to its security DNA while also evolving into a more disciplined and mature version of its “traditional” peacetime operating models.

1. Nothing is Normal And That’s Totally Normal

Israeli tech operates on borrowed sovereignty. When the Department of Government Expenditure cuts U.S. federal budgets, the tremor hits Tel Aviv's enterprise sector within months. Healthcare buyers, for example, who purchased Israeli cyber solutions suddenly freeze procurement. The exposure is structural: Israeli companies are deeply intertwined with U.S. enterprise buyers and VCs, even as relationships with Europe reach breaking point. Founders report subtle shifts—longer decision cycles, softer demand, heightened due diligence. For some global financial institutions, Israel’s ongoing success in tech now sits uncomfortably alongside a political narrative they no longer understand—or trust.

“Even wise, honest people… they do not fully understand, LPs are concerned or confused about Israel’s trajectory, and it seems to them that something has gone really wrong.”

2. Cyber and Defense: Conflict as a Service

Cybersecurity and defense have proven…resilient. Even as the war drains national morale, global trust, and public coffers, these 2 sectors have attracted capital and credibility. Defense exports are up. Cyber valuations are strong. Defense technologies, especially ones in unmanned systems, are benefiting from a surge in global demand for battlefield-proven innovation. But this growth comes at a cost: it is narrow, concentrated, and often reliant on ongoing conflict for momentum. Founders quietly ask: what if our over-dependence on the US turns against us? What would our growth look like if and when the guns fall silent? (I, for one, think that would be a good problem for Israel to have).

“The huge demand in defense might make it a little bit challenging for some companies to do non-defense stuff.”

3. Human Capital: Missing in Action Items

War doesn’t just deplete the labor force—hundreds of thousands of Israelis are on semi-permanent military rotation—it scrambles leadership. Entire executive teams have been pulled into reserve duty. Founders vanish for months, returning distracted, “altered”, or emotionally drained. Some don’t return. Business continuity plans are stretched beyond design. Investors report delays in product delivery, missed fundraising windows, and operational slowdowns. While the talent pool remains deep, its availability is fractured, and companies are paying the price in execution.

“I have two CEOs in two companies who disappeared for four and a half months. They came back a little different.”

Yet something has emerged from the battlefields: Israel’s best talent is flowing into defense and cyber. This is benefitting the dual-purpose military-commercial application space. The question is: how long can the humans of Startup Nation carry on like this?

4. What Are You Doing For War’s End?

There is a quiet consensus among Israel’s top investors: if/when the war ends, innovation will roar back. Call it the roaring mid-twenties. But if/when we get to the end of the war, what is the scene we’re likely to see?

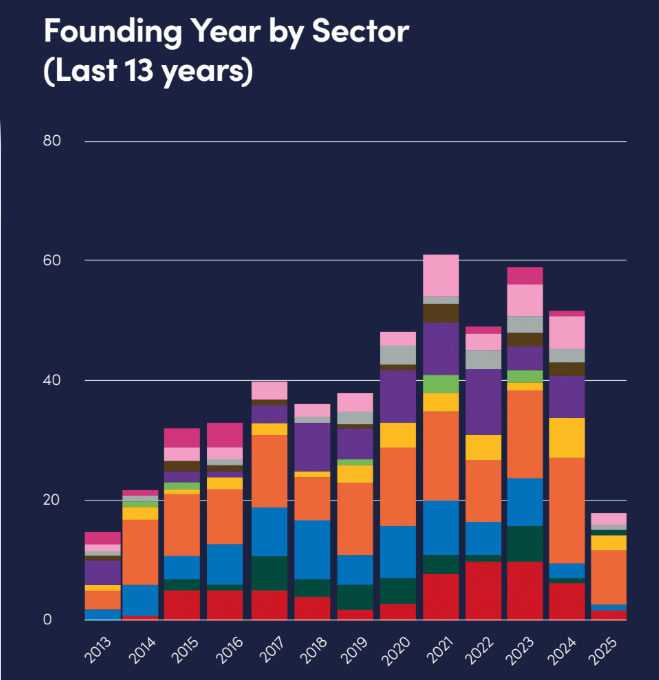

Unless you’re in cyber and defense, startup funding has slowed dramatically, and the circle of startups able to raise has narrowed. The number of new startups being founded in Israel has also dropped substantially, according to data from Startup Nation Central.

If and when political conditions improve, there will be time for a damage assessment. But the long-term outlook remains optimistic. New companies will emerge, talent will recycle, and infrastructure will be rebuilt. But this optimism is not evenly distributed. In foundational AI, for instance, Israel is playing catch-up. The current wave of innovation is thin on deep tech too, which is important enough to get its own section below:

“Post-crisis is the best time to invest.”

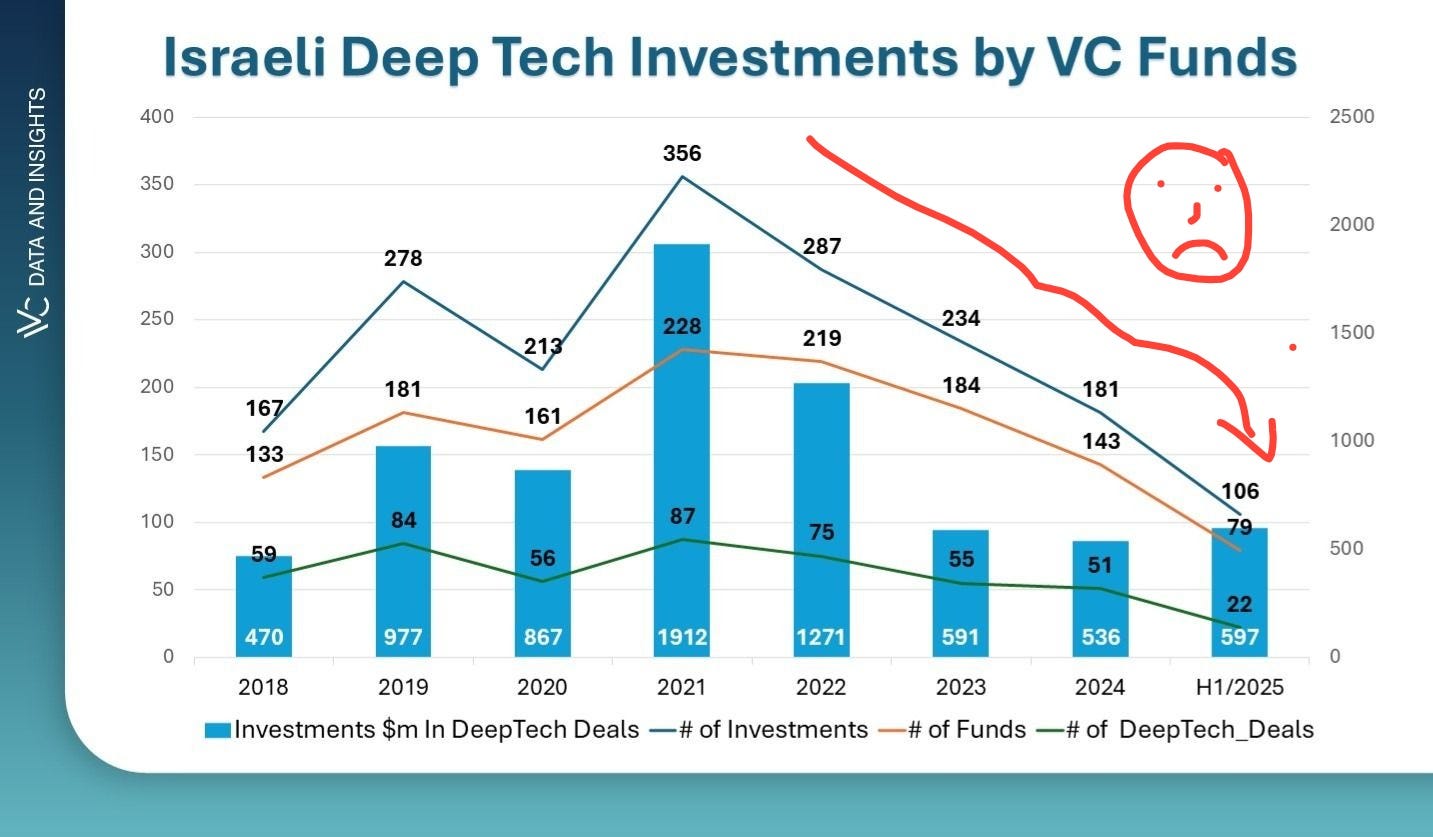

5. Israeli Deep Tech is in Deep Sh#t

What makes tech deep? Deep tech is built on hard-to-copy science like advanced chips, quantum hardware, new materials, robotics, energy storage, satellite systems, and biotech. These are the things that propel companies and nations forward, or keep them back if they’re not supported. They take years, cash, and sophisticated physical infrastructure to mature; they need labs, test rigs, clean rooms, and often factories rather than just cloud servers.

What’s happening to Israeli deep tech? Not good. The numbers are blunt. In the first half of 2025, Israeli deep tech raised $597m across just 22 deals; all of 2024 saw $536m across 51. Specialist funds fell from 25 to six. Of 247 active firms, roughly 70% are still in R&D or only starting to sell. Money is returning, but only to a few. [[Source: IVC Data & Insights, Gornitzky GNY, and KPMG Israel.]]

Less money going to new and growing research-led companies means Israel falls behind on the really, really important stuff. Apart from capital clustering around winners working on national priorities—security, energy, and critical infrastructure—the government might need to intervene here in a big way to boost new deep tech company formation and growth.

6. Chaos Junkies: Ego Is The Enemy

Investors emphasized a shift from traditional competency to adaptability. The qualities investors are now prioritizing: coachability, flexibility, resilience. In today’s climate, fixed mindsets are liabilities. Executives who have managed companies through wars, navigated uncertainty as routine, and maintained operations during existential crises possess skills the global market increasingly values.

Smart companies now hold monthly leadership reviews asking: “If we were launching this company today, would we build it the same way?” DEI is DOA. Managers aren’t asking how you feel, they’re asking how fast you can ship. Execution cycles are shorter. Strategic plans are obsolete within months. Your top software engineer can be called up for duty at any moment. Leadership is just as much about absorbing reality as setting vision. Founders are expected to operate with humility, urgency, and data.

"We here know what it is like to work, to study, to live, during wars, in a routine that is not a routine. What happened to us in the last three years... manifests with much more determination and resilience, and in this age, it is very beneficial for companies."

7. First We Take Manhattan. Then We Stay There

Zoom is no longer enough. Customers—especially in the U.S.—expect Israeli startups to be on the ground, culturally in sync, and physically present. Founders are relocating again, bucking the pre-2023 trend of growing their companies from Israel. Sales and GTM functions are long gone. Flights are tricky and expensive. Many are between reserve duty and business trips.

The U.S. has become Israel’s primary lifeline. To scale in 2025, Israeli companies feel they need boots on the ground in America (whenever their boots are not on the ground in Gaza).

Venture fund 97212 reports a sharp rise in Israeli-founded or Israeli-led startups in New York, counting about 560 active companies plus roughly 80 in stealth, totaling around 640—significantly higher than earlier tallies. Political and security turbulence in Israel is cited as a catalyst for relocation, amplified by the support of a now-dense Israeli tech community in New York.

“The Americans like to feel it… not just the Israeli playbook, but to prove the business in the United States.”

Closing Thoughts

None of this should be surprising. The stress, and strength, are real: on the 699th day of war, Israel’s tech sector sits on a knife’s edge, with a knife between its teeth. Resilient but exhausted. Tapped out but with a few tricks still up its sleeve.

For now, the ecosystem is holding, hardening and narrowing—like a heart artery in a person with hypertension, interrupted sleep, lots of money problems, and an addiction to chaos. But with a fresh wave of reserve call-ups, global investors watching closely, and Israel’s international reputation withering, Israeli tech is bracing, either for a resurgence or reckoning.

If and when the fighting ends, the true test will begin: is Israeli tech able to beat its Swords back into SaaS?

Interesting overview, thanks Amir.

I’m curious to know:

1. How could the lessons learned in Israel influence new “hyper-agile” methodologies for digital products development? I’m sure the world has a lot to learn here as we all face growing uncertainty

2. This interesting spike in Israeli tech in NYC makes me wonder if similar trends can be seen in Canada as well. It’ll be interesting to see some numbers on this.